- Olden Lane Newsletter

- Posts

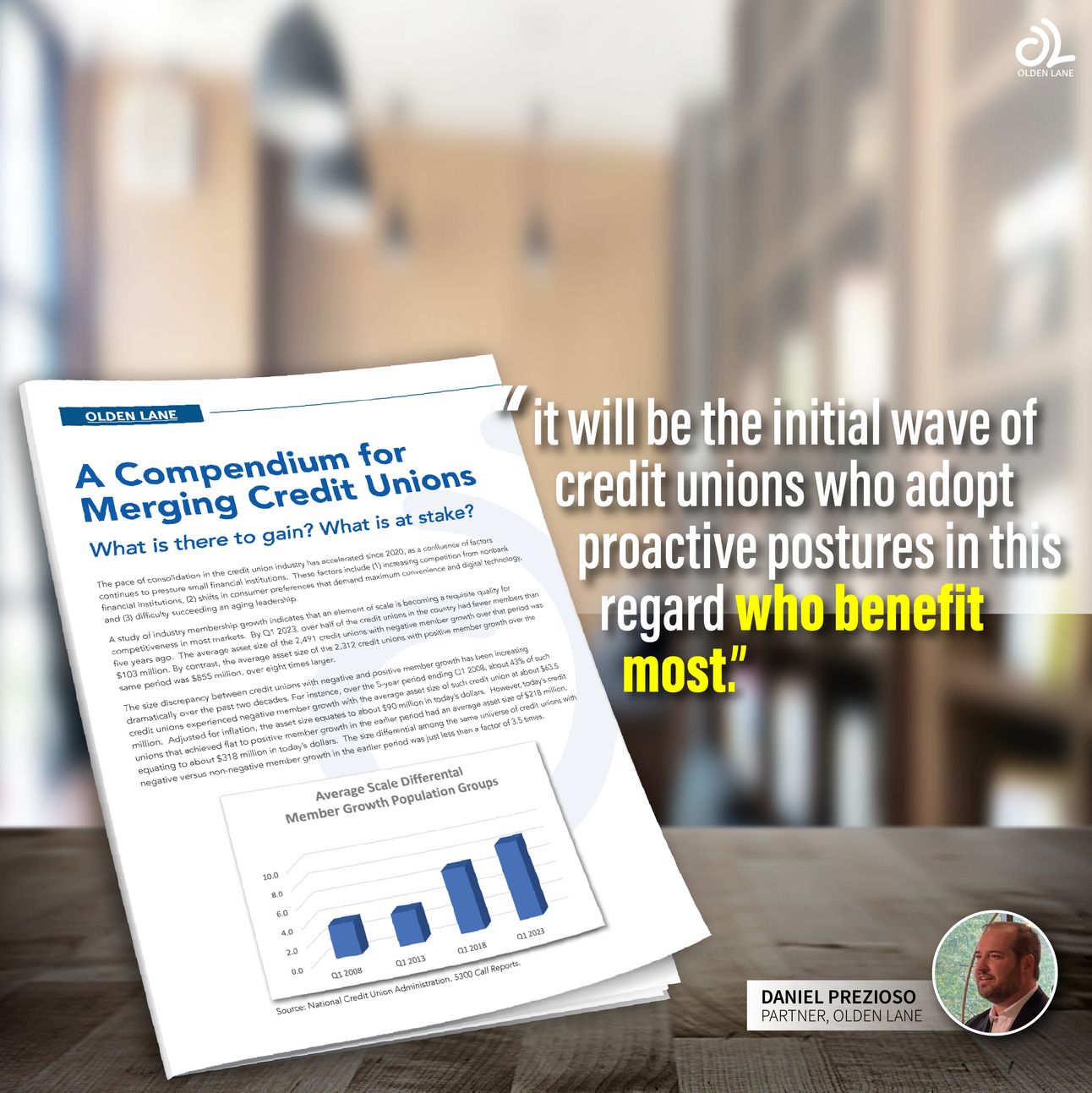

- A Compendium for Merging Credit Unions

A Compendium for Merging Credit Unions

What is there to gain? What's at stake?

🍁 Fall is here and we hope you’re doing well. This email contains a brief summary and link to our most recent value-add content.

Our latest whitepaper "A Compendium for Merging Credit Unions,” presents what’s at stake for credit unions facing increasing challenges amidst an evolving industry along with quickly changing market dynamics through a series of charts and data.

The size and shape of today’s market and the macroeconomic backdrop offer those credit unions that proceed strategically (1) much to gain as the merging credit union, (2) significant flexibility to protect their interests in a combination, and (3) ample opportunity to influence the combined credit union in the future by planning and negotiating shrewdly.

Whether maximizing the interests of its members, its employees, its communities, or its heritage, a merging credit union acting proactively has significant opportunity to form an arrangement that fits its needs. The key to successfully addressing these considerations is for the merging credit union to act from a position as a strong and desirable merger partner so it may engage in negotiations with optimal leverage.

We also suspect it will be the initial wave of credit unions who adopt proactive postures in this regard who benefit most. While credit union mergers do not hinge on a price, the terms that may be achieved by a merging credit union are certainly impacted by the primary factors of market behavior. That is, supply and demand. As the industry consolidation heats up due to (1) market conditions, (2) competitive dynamics, and (3) retirement of aging leadership, we expect more credit unions to reach for merger partners. Those credit unions that delay a proactive posture until conditions force such position upon them will likely find themselves amongst a more crowded field, limiting their ability to translate interest in a merger into the most favorable outcome.

We hope you find value in this content and look forward to continue bringing you industry insights, news, and perspective.